Wednesday, February 28, 2007

Fed Chairman Says Markets Working Well

Fed Chairman Says Markets Working Well

Wednesday February 28, 1:04 pm ET

By Martin Crutsinger, AP Economics Writer

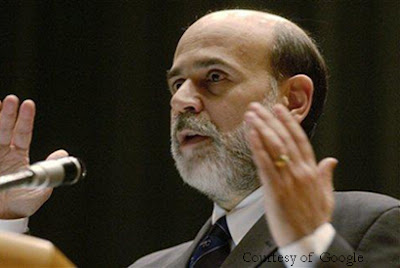

WASHINGTON (AP) -- Federal Reserve Chairman Ben Bernanke told Congress on Wednesday that the administration and federal regulators are closely monitoring financial markets in the wake of the biggest sell-off in stock prices in more than five years but so far the markets appear to be "working well."

Rather than the famously opaque language that predecessor Alan Greenspan sometimes employed, Bernanke answered lawmakers' questions with plain vanilla statements Wednesday that seemed to calm investor anxiety.

Testifying the day after the market's 416-point plunge, Bernanke told the House Budget Committee that the Fed was monitoring market developments but had seen nothing that would cause it to change its positive outlook for the economy.

Discussing market operations, he said, "They seem to be working well, normally."

In what might have been a reference to Greenspan, Bernanke said there did not appear to be just one cause for Tuesday's sell-off.

The possible causes suggested by analysts ranged from a record drop in China's Shanghai index, a surprisingly weak U.S. manufacturing report and weekend comments by Greenspan that raised the possibility of a U.S. recession by year's end.

"There didn't seem to be any single trigger of the market correction we saw yesterday," Bernanke told the House panel, speaking in a slow, deliberate voice with his hands folded in front of him at the witness table.

Bernanke let the lawmakers know he wouldn't be led into publicly contemplating what role Greenspan's remarks or any other developments had played in setting off the worst one-day point drop since Sept. 17, 2001, after the terrorist attacks.

"I don't think it would be useful for me to try to parse the movement into the components associated with different pieces of news or pieces of information," he said.

Bernanke began his testimony before a standing-room crowd and with close to two-dozen lawmakers eager to question him.

However, the crowd dwindled as most lawmakers seemed more intent on discussing the looming budget problems in the government's big benefit programs _ Social Security, Medicare and Medicaid _ than the market turmoil.

But investors on Wall Street liked what they heard. Bernanke's words had a calming effect, and investors pushed the Dow Jones industrial average up by 52.39 points to close at 12,268.63, a sharp contrast from Tuesday's 416-point loss.

House Budget Committee Chairman John Spratt, D-S.C., said in an interview after the hearing that Bernanke had supported his credibility by being careful to keep his comments "in the bounds of what he knows."

Mark Zandi, chief economist at Moody's Economy.com, praised Bernanke for an "excellent job" that delivered the key messages that the markets were functioning well and the Fed's views on the economy had not changed.

That was important, analysts said, because it let investors know the big stock sell-off had not exposed problems at major banks or brokerage houses and the Fed did not expect the sudden loss of $632 billion in paper wealth to alter the economy's performance in a major way.

Bernanke noted that the government had reported earlier Wednesday that the overall economy, as measured by the gross domestic product, grew by just 2.2 percent at an annual rate in the final three months of last year.

While that was a sharp downward revision from the initial estimate of 3.5 percent, Bernanke said it was in line with the Fed's expectations.

"There's a reasonable possibility that we'll see some strengthening of the economy sometime in the middle of the year," Bernanke said, voicing the hope that the severe slump in housing and an effort by businesses to work off unwanted inventories would be less of a drag in coming months.

"We expect moderate growth going forward," he said, sticking with the upbeat forecast he delivered to Congress two weeks ago.

Nariman Behravesh, chief economist at Global Insight, said there could be more market volatility in coming weeks, but he believed the economy would accelerate slightly as the year moved forward.

"The markets needed to hear a voice of calm and Bernanke succeeded in that role," Behravesh said.

Bernanke's comments on the stock market occurred at a hearing during which he also delivered virtually identical warnings as he had in January about the need to deal with looming budget problems in Social Security, Medicare and Medicaid.

At the White House, press secretary Tony Snow said Wednesday that President Bush had called Treasury Secretary Henry Paulson to get a readout on the stock market plunge.

Asked what advice the president would give to investors, Snow said, "The president does not give advice to investors in the stock market."

Geithner Says Fed Cannot Prevent Asset Bubbles

Earlier, New York Federal Reserve President Timothy Geithner made a separate speech before a risk management conference. Like Bernanke, Geithner did not address the pullback in U.S. stocks in his prepared remarks.

Instead, he focused on the role of the Federal Reserve. Central banks should not focus on using policy to prevent asset bubbles, especially because liquidity is so difficult to measure, Geithner said.

Large hedge funds, in particular, pose a unique challenge to policy-makers because of their secretive nature and use of multiple counterparties.

"Central banks cannot realistically hold out the prospect of using monetary policy to prevent asset bubbles, conditions of 'excess' leverage in parts of the financial system, or other factors in markets that might lead to the types of positive feedback dynamics that were at the heart of some past crises," he said.

He said that despite the importance of financial market liquidity to monetary policy, no indicators provide a "ready guide" to decisions on setting interest rates. Such is the challenge for central bankers.

"Central banks need to stand prepared to make appropriate monetary policy adjustments if changes in financial conditions would otherwise threaten the achievement of the goals of prices stability and sustainable economic growth," he said.

**** (COMMENT: What they are saying is MORAL HAZZARD is full throttle. They won't do shit to stop an out of control bubble, but will do everything they can to sustain it when it bursts.) ****

___

AP