Wednesday, February 28, 2007

Bad Data Spur Market Doubts Among U.S. Investors

Bad Data Spur Market Doubts Among U.S. Investors

By Edgar Ortega and Eric Martin

Feb. 28 (Bloomberg) -- The U.S. stock market lost a measure of trust with traders and investors after computer malfunctions sent the Dow Jones Industrial Average plummeting 178 points in one minute yesterday.

``The system should be able to handle the capacity when you have high-volume days,'' said Thomas Garcia, head of trading at Thornburg Investment Management, which oversees about $34 billion in Santa Fe, New Mexico. ``If I was making decisions based off of bad data, then yeah, I have a huge problem with that.''

Dow Jones & Co. said its computers were responsible for the sudden nosedive in the 30-stock benchmark about an hour before markets closed because they failed to keep up with trades. The New York Stock Exchange said separately that it experienced ``intermittent delays'' in prices. Nasdaq Stock Market Inc. reported slower distribution of some market data. Together the two markets handle almost 90 percent of all shares that trade in the U.S., the world's biggest equity market.

Some NYSE floor brokers resorted to pen and paper to complete trades, while others scrambled to keep up with orders after an overnight sell-off in Chinese stocks spread globally and sparked the biggest U.S. rout in four years. The 3.3 billion shares that traded on the Nasdaq was the most in almost five years. Some 2.4 billion shares traded at the NYSE, the highest volume since June.

Record at CBOE

It was the busiest day on record at the Chicago Board Options Exchange, the largest U.S. options market. Some 6.8 million contracts changed hands, eclipsing the previous record of 5.8 million reached in May 2006, according to the exchange.

``The extraordinary heavy trading volume caused a delay in our Dow Jones Industrial Average data,'' said Sybille Reitz, a spokeswoman at New York-based Dow Jones, publisher of the Wall Street Journal and Barron's. ``As we identified the problem we switched over to a backup system and the result was a rapid catch up in the public value for the Dow.''

Dow Jones, which created the price-weighted benchmark in 1896, alerted stock, futures and options exchanges that rely on the average ``pretty early'' after noticing the problem, Reitz said. ``We switch back and forth between data servers all the time for maintenance reasons, but have never had a delay like this in the reporting of the index,'' she said.

Taking Steps

Yesterday's malfunction began at about 1:50 p.m. and was fixed by 3:00 p.m. Dow Jones said in a statement that it expects the average to read correctly today and is taking steps to prevent similar problems in the future.

Bloomberg LP, the parent of Bloomberg News, competes with Dow Jones in selling financial news and information.

A chart of the Dow average shows a steady decline until 2:59 p.m., when the line heads straight down as the backup servers at Dow Jones kicked in, tabulating trades done earlier in the day.

Michael Driscoll, a trader at Bear Stearns Cos., noted that the Dow average was down about 300 points when he turned away from the chart to take a phone call just before 3 p.m. in New York. By the time he looked up again, the losses had almost doubled.

``When the dam broke, that's when we saw the market go from down 250 to down 550 literally in a couple of seconds,'' said Driscoll, senior managing director at New York-based Bear Stearns.

The sudden plunge fueled a wave of new orders that overwhelmed systems at stock exchanges in the final hour of trading. Warren Meyers, a managing director at NYSE brokerage Walter J. Dowd Inc., started scribbling trades on paper after the delays made it impossible to determine the fate of an electronic order. He ended up with more shares than he wanted.

Captive to Computers

The debacle reminded many traders how captive the market has become to computers.

``I noticed some problems early in the day, but after 3 p.m. it was floor-wide,'' Meyers said. ``People want speed and they want the anonymity of electronic trading, but when the markets get roiled they look to humans to handle trades efficiently and we weren't able to do that. It's frightening when you're in the New York Stock Exchange and you can't trade.''

Just last March, the 214-year-old New York Stock Exchange embraced electronic trading with the purchase of Archipelago Holdings Inc. It's now acquiring Paris-based Euronext NV, a $12.5 billion trans-Atlantic deal that involves the integration of stock markets on an unprecedented scale.

Surge in Volatility

The Dow ended up declining 416.02, or 3.3 percent, to 12,216.24 yesterday, the biggest slide since March 2003. At the day's low, which followed the malfunction at Dow Jones, the average was down 546.2 points. The last time it fell as much was Sept. 17, 2001, the first trading day after terrorists destroyed the World Trade Center in downtown New York, killing more than 2,700 people.

The CBOE SPX Volatility Index, an indicator known as the VIX that measures the perceived risk of stock-market swings, rose 64 percent -- the most ever.

The market drop started in China, where the Shanghai and Shenzhen 300 Index tumbled 9.2 percent yesterday, wiping out $107.8 billion of market value. Indexes in Europe then declined more than 2 percent. Today, stocks in Japan and Hong Kong fell, while the Shanghai index gained 3.5 percent.

The Dow average rose 0.42 percent and the Standard & Poor's 500 Index gained 0.55 percent in trading today. The Nasdaq Composite Index advanced 0.34 percent.

`Wake-Up Call'

Bruce Bartlett, director of growth equity investments at Lord Abbett & Co. in Jersey City, New Jersey, said the reports of data problems at the exchanges concerned him more than yesterday's market decline.

``It's not particularly scary in the context of the 1987 crash,'' said Bartlett. ``A lot of it's really going to bear on what happened on the floor of the exchange.''

New market rules next month may cause recurring problems at the exchanges, said Joe Rosen, who until April was a managing director of trading technology at the NYSE. Regulation National Market System, commonly known as Reg NMS, takes effect March 5, forcing brokers and exchanges to route orders to the market with the best price available for automatic execution.

``This is a foreboding of what's going to happen when you have the quotes flickering and orders getting routed here and there,'' said Rosen, president of brokerage consultant RKA Inc. ``This is a wake-up call.''

Prices Got `Interesting'

Some investors took advantage of yesterday's rout to buy stocks. Bartlett said Lord Abbett added to positions in some technology stocks. Benjamin Wallace, who helps oversee $650 million at Grimes & Co. in Westborough, Massachusetts, asked his trader to buy shares of Progressive Corp., Novartis AG and Chesapeake Energy Corp. at about 3 p.m. New York time.

``Things started to accelerate and prices were interesting,'' Wallace said. ``As long as the real catalyst is this issue in China, it's short-term.''

Jim Russell, an equity strategist at Fifth Third Asset Management, a Cincinnati money manager that oversees $21.8 billion, said he's reluctant to increase stock holdings until the markets stabilize.

``While a couple of stocks are starting reach a point where they're starting to look attractive, we aren't going to step in front of what could be a freight train,'' he said.

For Kenneth Polcari, a managing director at ICAP Plc's equities unit, the question isn't whether stocks were poised for an extended slump after four straight years of gains. It's how quickly stocks bounce back.

``The technology issues created some anxiety, which exacerbated the market's move,'' said Polcari, an NYSE broker for more than 25 years. ``The institutional investor understands that the market had to take a breather.''

To contact the reporters on this story: Edgar Ortega in New York at ebarrales@bloomberg.net ; Eric Martin in New York at emartin21@bloomberg.net .

Last Updated: February 28, 2007 16:07 ESTNew home sales plunge

New home sales plunge

Annual pace, below 1 million, posts biggest monthly decline in 13 years; rising glut of homes for sale hits prices.

NEW YORK (CNNMoney.com) -- New home sales saw their steepest plunge in 13 years in January, a government report said Wednesday, as a rising glut of new houses on the market pushed prices lower.

New homes sold at an annual rate of 937,000, down 16.6 percent from the December reading of 1.1 million. Economists surveyed by Briefing.com had forecast only a narrow drop to a 1.08 million pace.

The decline in sales hit every region of the country, from a 8.1 percent drop in the Midwest to a 37.4 percent dive in the West. The South, which accounts for more than half of the nation's new home sales, saw January's pace off nearly 10 percent compared to December.

The percentage decline was biggest for a single month in 13 years, since the record 23.8 percent decline seen in January 1994. It is also the sixth largest one-month fall on record.

"Let's cut to the chase - these numbers were ugly," wrote Mike Larson, real estate analyst at Weiss Research in Jupiter., Fla. "While the month-to-month changes in new home sales figures can be volatile, the magnitude of the decline is impressive.

"This speaks volumes about the ongoing weakness in the housing sector. Inventories remain elevated. Housing affordability remains low, historically speaking," Larson continued. "And now, mortgage lending standards are tightening. All of this bodes ill for the 2007 spring selling season. I don't expect a true, lasting rebound in housing until at least 2008."

David Seiders, chief economist for the National Association of Home Builders, said that the sharp drop in January might have been fed by stronger-than-expected sales in November and December, when much of the country had unseasonably warm weather. The new home sales are recorded at the time a sales contract is signed, rather than when the sale is closed.

"I sort of always knew that late last year our numbers were boosted by unusually warm weather and we paid some of that back in January," said Seiders. But he also conceded that the report showed continued and widespread weakness, despite hopes late last year that the market could be stabilizing.

"It's obvious the market has not lifted off the ground yet," he said.

The January sales pace is the lowest since February 2003, before the start of the building boom that flooded the market with new homes available for sale and put downward pressure on prices and builders' earnings.

The median price of a new home fell 2.1 percent from a year earlier to $239,800, although that was $400 above the December price level. Median is the point at which half the homes sell for more and half sell for less.

The latest median price is down 6.7 percent from the record high reached in April 2006. And the report doesn't capture all the decline in pricing power for builders, since a majority of them are offering extra features at no additional cost, agreeing to pay buyers' closing expenses and other incentives to move houses.

The prices have seen downward pressure from the glut of completed homes on the market available for sale. The report shows a record 175,000 completed homes for sale in January, the eighth straight month that reading has risen to a record level.

The median time it takes a completed home to sell now stands at 4.8 months, the longest wait for builders since July 2001, when the nation was in a recession.

While builders have trimmed the pipeline of new homes under construction and available for sale, the supply of all new homes available for sale stands at 7.7 months, up from a 6.9 month supply in December.

Home builders have been particularly hard hit by the downturn in home sales and home prices. Hovnanian Enterprises (Charts) said Tuesday it expects to report a net loss in the most recent quarter. Toll Brothers (Charts) reported a sharp drop in earnings last week, while KB Home (Charts) reported a net loss in the most recent quarter earlier this month.

Other leading builders reporting weakness in prices and reduced sales include Lennar (Charts), Pulte Home (Charts), D.R. Horton (Charts).

The slowdown in housing has also hurt some major home improvement retailers. Earlier Wednesday, Home Depot said it doesn't expect a recovery in home building and real estate until late 2007 or early 2008, and it warned that its sales and earnings would miss forecasts as a result.

Shares of Home Depot (Charts), a Dow component, were narrowly lower in late-morning trading as other blue chip stocks rebounded after Tuesday's market plunge.

Other economic readings suggest that the weakness in new home sales and prices are being seen in the broader real estate market as well.

On Tuesday, the National Association of Realtors' report on existing home sales showed the sixth straight month of a year-over-year decline in median price, even as the pace of sales picked up slightly.

That trade group's report on fourth quarter sales and prices in the nation's various metropolitan areas also reported the most widespread and deepest decline in prices on record.

Economy Grows Slower Than Expected in 4Q

Wednesday February 28, 3:03 pm ET

By Jeannine Aversa, AP Economics Writer

The latest batch of economic reports from the Commerce Department on Wednesday pointed to a temporary economic listlessness rather than signaling the economy would slip into recession, economists said.

Ken Mayland, president of ClearView Economics, called it a "midcourse breather."

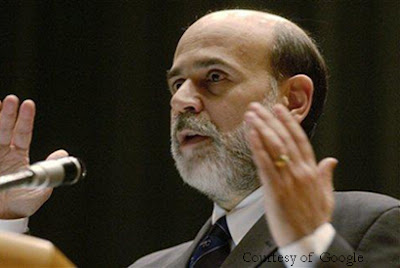

The reports came a day after stocks at home and abroad took a nosedive as investors worried about the economic health of global powerhouses, the United States and China. Wall Street rebounded on Wednesday as Federal Reserve Chairman Ben Bernanke sought to calm investors' nerves and allay fears about a major economic slowdown. Bernanke said the Fed was looking for "moderate growth in the U.S. economy going forward."

The Dow Jones industrials, which had been up more than 130 points earlier in the day, finished the session with a gain of 52.39 points to 12,268.63.

The new reading on gross domestic product showed the economy grew at a 2.2 percent pace -- a considerably weaker rate than the government first estimated. It initially had reported the expansion in the last three months of 2006 to be at a 3.5 percent pace. The principal reason for the new, significantly lower estimate: Businesses tightened their belts amid fallout from the troubled housing and automative sectors.

Bernanke said he wasn't worried about the GDP's downward revision, saying the new reading "is actually more consistent with our overall view of the economy than were the original numbers."

The fresh look at the housing market was sobering. New-home sales plummeted by 16.6 percent in January from the previous month. That was the largest decline since January 1994, when sales slid by 23.8 percent.

The decline in January -- much steeper than analysts anticipated -- left sales at a seasonally adjusted annual rate of 937,000, the lowest level since February 2003.

As sales cooled, so did home prices.

The median sales price of a new home -- where half sell for more and half for less -- dropped to $239,800 in January, down 2.1 percent from the same month last year.

The new GDP figure for the October-to-December quarter was a tad slower than the 2.3 percent growth rate economists were forecasting and clearly less sunny than the original estimate. The GDP, which measures the value of all goods and services produced within the United States, is the best overall barometer of economic health.

Although the fourth quarter's showing marked a slight improvement from the third quarter's mediocre 2 percent growth rate, it didn't alter the overall picture that economic activity in both quarters was restrained by the housing slump and the ailing automotive sector.

Investment in home building in the fourth quarter was slashed by 19.1 percent on an annualized basis, the steepest decline in 15 years.

Business retrenchment was a key factor behind the lower GDP estimate for the fourth quarter. Businesses, worried that extra supplies of goods might get out of whack with customer demand, ended up investing much less in their inventories than previously thought. That shaved 1.35 percentage points off the fourth-quarter GDP, the most in 1 1/2 years.

Companies also ended up cutting back on other spending and investment in the fourth quarter, including equipment and software, new plants and other commercial buildings.

Consumers, a major force shaping overall economic activity, boosted spending at a 4.2 percent pace in the final quarter of last year. That was brisk -- and up considerably from a 2.8 percent pace in the prior quarter. But it also was slightly less than the 4.4 percent growth rate first estimated for the final quarter of last year. That also played a role in the GDP downgrade in the fourth quarter.

Such a big revision in fourth quarter GDP -- to a 2.2 percent pace from the initial 3.5 percent pace -- was unusual. The government said the average revision is much smaller -- 0.5 percentage point. "A revision of 1.3 percentage points or larger has occurred only seven times in 30 years," it said.

Analysts predict the economy will stay sluggish for a while, reflecting continued strain from the housing sector. The economy should clock in at a 2.5 percent pace in the current January-to-March quarter, edge up to a 2.6 percent pace in the April-to-June period, according to projections by the National Association for Business Economics.

Of the latest GDP figures: "Overall these data confirm a sustained downshift in growth," said Ian Shepherdson, chief economist at High Frequency Economics.

GDP and new-homes sales reports: http://www.economicindicators.gov/

Fed Chairman Says Markets Working Well

Fed Chairman Says Markets Working Well

Wednesday February 28, 1:04 pm ET

By Martin Crutsinger, AP Economics Writer

WASHINGTON (AP) -- Federal Reserve Chairman Ben Bernanke told Congress on Wednesday that the administration and federal regulators are closely monitoring financial markets in the wake of the biggest sell-off in stock prices in more than five years but so far the markets appear to be "working well."

Rather than the famously opaque language that predecessor Alan Greenspan sometimes employed, Bernanke answered lawmakers' questions with plain vanilla statements Wednesday that seemed to calm investor anxiety.

Testifying the day after the market's 416-point plunge, Bernanke told the House Budget Committee that the Fed was monitoring market developments but had seen nothing that would cause it to change its positive outlook for the economy.

Discussing market operations, he said, "They seem to be working well, normally."

In what might have been a reference to Greenspan, Bernanke said there did not appear to be just one cause for Tuesday's sell-off.

The possible causes suggested by analysts ranged from a record drop in China's Shanghai index, a surprisingly weak U.S. manufacturing report and weekend comments by Greenspan that raised the possibility of a U.S. recession by year's end.

"There didn't seem to be any single trigger of the market correction we saw yesterday," Bernanke told the House panel, speaking in a slow, deliberate voice with his hands folded in front of him at the witness table.

Bernanke let the lawmakers know he wouldn't be led into publicly contemplating what role Greenspan's remarks or any other developments had played in setting off the worst one-day point drop since Sept. 17, 2001, after the terrorist attacks.

"I don't think it would be useful for me to try to parse the movement into the components associated with different pieces of news or pieces of information," he said.

Bernanke began his testimony before a standing-room crowd and with close to two-dozen lawmakers eager to question him.

However, the crowd dwindled as most lawmakers seemed more intent on discussing the looming budget problems in the government's big benefit programs _ Social Security, Medicare and Medicaid _ than the market turmoil.

But investors on Wall Street liked what they heard. Bernanke's words had a calming effect, and investors pushed the Dow Jones industrial average up by 52.39 points to close at 12,268.63, a sharp contrast from Tuesday's 416-point loss.

House Budget Committee Chairman John Spratt, D-S.C., said in an interview after the hearing that Bernanke had supported his credibility by being careful to keep his comments "in the bounds of what he knows."

Mark Zandi, chief economist at Moody's Economy.com, praised Bernanke for an "excellent job" that delivered the key messages that the markets were functioning well and the Fed's views on the economy had not changed.

That was important, analysts said, because it let investors know the big stock sell-off had not exposed problems at major banks or brokerage houses and the Fed did not expect the sudden loss of $632 billion in paper wealth to alter the economy's performance in a major way.

Bernanke noted that the government had reported earlier Wednesday that the overall economy, as measured by the gross domestic product, grew by just 2.2 percent at an annual rate in the final three months of last year.

While that was a sharp downward revision from the initial estimate of 3.5 percent, Bernanke said it was in line with the Fed's expectations.

"There's a reasonable possibility that we'll see some strengthening of the economy sometime in the middle of the year," Bernanke said, voicing the hope that the severe slump in housing and an effort by businesses to work off unwanted inventories would be less of a drag in coming months.

"We expect moderate growth going forward," he said, sticking with the upbeat forecast he delivered to Congress two weeks ago.

Nariman Behravesh, chief economist at Global Insight, said there could be more market volatility in coming weeks, but he believed the economy would accelerate slightly as the year moved forward.

"The markets needed to hear a voice of calm and Bernanke succeeded in that role," Behravesh said.

Bernanke's comments on the stock market occurred at a hearing during which he also delivered virtually identical warnings as he had in January about the need to deal with looming budget problems in Social Security, Medicare and Medicaid.

At the White House, press secretary Tony Snow said Wednesday that President Bush had called Treasury Secretary Henry Paulson to get a readout on the stock market plunge.

Asked what advice the president would give to investors, Snow said, "The president does not give advice to investors in the stock market."

Geithner Says Fed Cannot Prevent Asset Bubbles

Earlier, New York Federal Reserve President Timothy Geithner made a separate speech before a risk management conference. Like Bernanke, Geithner did not address the pullback in U.S. stocks in his prepared remarks.

Instead, he focused on the role of the Federal Reserve. Central banks should not focus on using policy to prevent asset bubbles, especially because liquidity is so difficult to measure, Geithner said.

Large hedge funds, in particular, pose a unique challenge to policy-makers because of their secretive nature and use of multiple counterparties.

"Central banks cannot realistically hold out the prospect of using monetary policy to prevent asset bubbles, conditions of 'excess' leverage in parts of the financial system, or other factors in markets that might lead to the types of positive feedback dynamics that were at the heart of some past crises," he said.

He said that despite the importance of financial market liquidity to monetary policy, no indicators provide a "ready guide" to decisions on setting interest rates. Such is the challenge for central bankers.

"Central banks need to stand prepared to make appropriate monetary policy adjustments if changes in financial conditions would otherwise threaten the achievement of the goals of prices stability and sustainable economic growth," he said.

**** (COMMENT: What they are saying is MORAL HAZZARD is full throttle. They won't do shit to stop an out of control bubble, but will do everything they can to sustain it when it bursts.) ****

___

AP